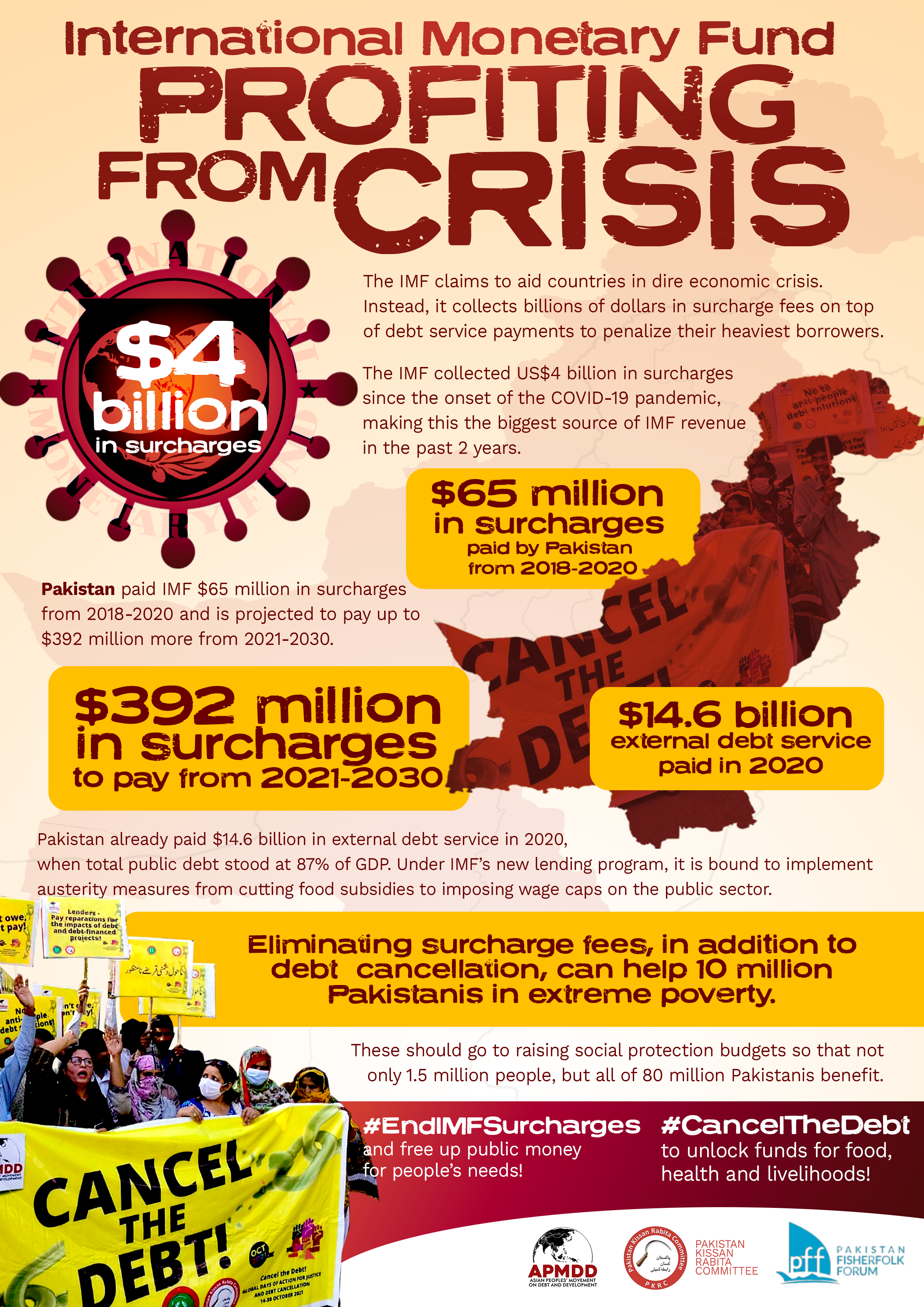

Apart from harsh conditionalities, IMF also imposes surcharges on the loans received by Pakistan. These surcharges and unnecessary and harmful and should immediately be withdrawn. Pakistan already paid an estimated US$65 million in surcharges from 2018 to 2020. That means over 11 billion Rupees. Pakistan is projected to pay $392 million more from 2021-2030.

Surcharges are fees that the IMF charges member-countries for late payments and loans that exceed their quotas. There are two types of surcharges: quota-based are applied when the size of the country’s loan exceeds 187.5 percent of its IMF quota; and, time-based which are applied to loans outstanding after 35 to 51 months, depending on the credit facility.

Member-states (especially middle income) borrow from IMF when experiencing crises to assist in their balance of payments problems, financial crises, or unmanageable fiscal deficits and excessive debts. Ironically, however, IMF “assistance” means that countries facing greater crises, are also the ones facing the greatest risk of eventually defaulting and/or borrowing more.

Pakistan is one of the biggest borrower-countries of IMF. In 2020, Pakistan’s total public debt already stood at 87% of GDP. In dollar terms, Pakistan paid external debt service amounting to US$14.6 Billion in 2020.

Surcharges are paid in addition to interest payments and principal amortizations, thus adding to the country’s debt burden. This, despite the fact that Pakistan's present PTI government has fulfilled almost all harsh conditionalities of IMF, resulting in historic price hikes and deepening poverty.

To receive the last trench of the IMF $6 billion loan approved in 2019, Pakistan met several conditions in the mini budget passed on 23 January 2022 as well as in a bill to hand over the administrative and political powers of the State Bank of Pakistan to IMF, ostensibly to “grant [it] more autonomy”.

The agriculture sector is about to be the first victim of this economic decision. Farmers have been holding protests against the government for the shortage of essential crop inputs, expensive agriculture equipment and tools, and higher taxes.

Withdrawing subsidies including for food, electricity, fertilisers and fuel has resulted in greater costs for farmers. Electricity subsidies for tube-wells have been totally withdrawn and thus watering crops has become even more expensive. The average expenditure contraction in 2021 was projected at 3.3% of GDP.

Social Protection has been shifted for the rich. The wealthy, including the agriculture business companies, have been bailed out by state subsidies.

Meanwhile, due to so-called rationalisation and narrow targeting, the poorest section of the population receives much smaller social protection benefits, while most people are excluded. Out of 80 million, only 1.5 million people have been able to benefit.

Imposition of IMF austerity conditionalities and levying surcharges have also contributed to the dire state of public services such as the health sector which has been downsized or privatised. The introduction of health cards is the latest and the biggest scam that only favours private hospital mafia. Public money is handed over to private health companies in the name of providing health facilities for the poor.

As many as 10 million Pakistanis have already been pulled into absolute poverty. Up to 46% of the population (over 80 million) was already below the poverty line before the pandemic. This is estimated to increase by 5-6% due to the multiple crises intensified by Covid-19.

Pakistan’s massive and increasing debt burden means that it is compelled to meet debt service requirements at great human and social cost. For now, gone are the concerns about how to “pay for” it all. Instead, we are seeing wartime levels of spending that do not redound to people’s benefit, which have increased deficits and the public debt to new highs. Working classes have been forced to bear the effect of this mounting debt burden through more indirect taxation, as a result.

It is unconscionable that the IMF has collected over $4 billion in surcharges since the start of the COVID-19 pandemic and made surcharges the IMF's largest source of revenue for that period.

We call on the IMF’s Executive Board to carry out an immediate review of the surcharge policy, ensure transparency around past and future surcharge payments, and challenge it to align the institution with its mandate by eliminating surcharges.

We call on the Pakistan government for a Debt and surcharges retirement of at least four years and spend the saved amount on public services, including massive grants for farmers and peasants in the prices of oil, electricity and gas.

Farooq Tariq, Saima Zia

Pakistan Kissan Rabita Committee

Asian Peoples’ Movement on Debt and Development (APMDD)

Khalid Shah

Committee for the Abolition of Illegitimate Debt (CADTM)